Why Monte Carlo Works

Lecture 11

September 20, 2023

Review and Questions

Monte Carlo Simulation

Monte Carlo is stochastic simulation.

Goals of Monte Carlo

Monte Carlo is a broad method, which can be used to:

- Obtain probability distributions of outputs (uncertainty propagation);

- Estimate deterministic quantities (Monte Carlo estimation).

Monte Carlo Estimation

Monte Carlo estimation involves framing the (deterministic) quantity of interest as a summary statistic of a random process.

Questions?

Text: VSRIKRISH to 22333

Monte Carlo: More Formally

Why Monte Carlo Works

We can formalize Monte Carlo estimation as the computation of the expected value of a random quantity \(Y\), \(\mu = \mathbb{E}[Y]\).

To do this, generate \(n\) independent and identically distributed values \(Y_1, \ldots, Y_n\). Then the sample estimate is

\[\tilde{\mu}_n = \frac{1}{n}\sum_{i=1}^n Y_i\]

Monte Carlo (Formally)

More generally, we want to compute some quantity \(Y=f(X)\), where \(X\) is distributed according to some probability distribution \(p(x)\) and \(f(x)\) is a real-valued function over a domain \(D\).

Then \[\mu = \mathbb{E}(Y) = \int_D f(x)p(x)dx.\]

The Law of Large Numbers

If

\(Y\) is a random variable and its expectation exists and

\(Y_1, \ldots, Y_n\) are independently and identically distributed

Then by the weak law of large numbers:

\[\lim_{n \to \infty} \mathbb{P}\left(\left|\tilde{\mu}_n - \mu\right| \leq \varepsilon \right) = 1\]

The Law of Large Numbers

In other words, eventually Monte Carlo estimates will get within an arbitrary error of the true expectation. But how large is large enough?

Note that the law of large numbers applies to vector-valued functions as well. The key is that \(f(x) = Y\) just needs to be sufficiently well-behaved.

Monte Carlo Sample Mean

The sample mean \(\tilde{\mu}_n = \frac{1}{n}\sum_{i=1}^n Y_i\) is itself a random variable.

With some assumptions (the mean of \(Y\) exists and \(Y\) has finite variance), the expected Monte Carlo sample mean \(\mathbb{E}[\tilde{\mu}_n]\) is

\[\frac{1}{n}\sum_{i=1}^n \mathbb{E}[Y_i] = \frac{1}{n} n \mu = \mu\]

So the Monte Carlo estimate is an unbiased estimate of the mean.

Monte Carlo Error

We’d like to know more about the error of this estimate for a given sample size. The variance of this estimator is

\[\tilde{\sigma}_n^2 = \text{Var}\left(\tilde{\mu}_n\right) = \mathbb{E}\left((\tilde{\mu}_n - \mu)^2\right) = \frac{\sigma_Y^2}{n}\]

So as \(n\) increases, the standard error decreases:

\[\tilde{\sigma}_n = \frac{\sigma_Y}{\sqrt{n}}\]

Monte Carlo Error

In other words, if we want to decrease the Monte Carlo error by 10x, we need 100x additional samples. This is not an ideal method for high levels of accuracy.

Monte Carlo is an extremely bad method. It should only be used when all alternative methods are worse.

— Sokal, Monte Carlo Methods in Statistical Mechanics, 1996

But…often most alternatives are worse!

When Might We Want to Use Monte Carlo?

- All models are wrong, and so there always exists some irreducible model error. Can we reduce the Monte Carlo error enough so it’s less than the model error and other uncertainties?

- We often need a lot of simulations. Do we have enough computational power?

When Might We Want to Use Monte Carlo?

If you can compute your answers analytically, you probably should.

But for many systems problems, this is either

- Not possible;

- Requires a lot of stylization and simplification.

Monte Carlo Confidence Intervals

This error estimate lets us compute confidence intervals for the MC estimate.

What is a Confidence Interval?

Remember: an \(\alpha\)-confidence interval is an interval such that \(\alpha \%\) of intervals constructed after a given experiment will contain the true value.

It is not an interval which contains the true value \(\alpha \%\) of the time. This concept does not exist within frequentist statistics, and this mistake is often made.

How To Interpret Confidence Intervals

To understand confidence intervals, think of horseshoes!

The post is a fixed target, and my accuracy informs how confident I am that I will hit the target with any given toss.

How To Interpret Confidence Intervals

But once I make the throw, I’ve either hit or missed.

The confidence level \(\alpha\%\) expresses the pre-experimental frequency by which a confidence interval will contain the true value. So for a 95% confidence interval, there is a 5% chance that a given sample was an outlier and the interval is inaccurate.

Monte Carlo Confidence Intervals

OK, back to Monte Carlo…

Basic Idea: The Central Limit Theorem says that with enough samples, the errors are normally distributed:

\[\left\|\tilde{\mu}_n - \mu\right\| \to \mathcal{N}\left(0, \frac{\sigma_Y^2}{n}\right)\]

Monte Carlo Confidence Intervals

The \(\alpha\)-confidence interval is: \[\tilde{\mu}_n \pm \Phi^{-1}\left(1 - \frac{\alpha}{2}\right) \frac{\sigma_Y}{\sqrt{n}}\]

For example, the 95% confidence interval is \[\tilde{\mu}_n \pm 1.96 \frac{\sigma_Y}{\sqrt{n}}.\]

Implications of Monte Carlo Error

Converging at a rate of \(1/\sqrt{n}\) is not great. But:

- All models are wrong, and so there always exists some irreducible model error.

- We often need a lot of simulations. Do we have enough computational power?

Implications of Monte Carlo Error

If you can compute your answer analytically, you probably should.

But often this is difficult if not impossible without many simplifying assumptions.

More Advanced Monte Carlo Methods

This type of “simple” Monte Carlo analysis assumes that we can readily sample independent and identically-distributed random variables. There are other methods for when distributions are hard to sample from or uncertainties aren’t independent.

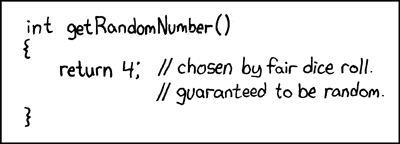

On Random Number Generators

Random number generators are not really random, only pseudorandom.

This is why setting a seed is important. But even that can go wrong…

Source: XKCD #221

Key Takeaways

Key Takeaways

- Choice of probability distribution can have large impacts on uncertainty and risk estimates: try not to use distributions just because they’re convenient.

- Monte Carlo: Estimate expected values of functions using simulation.

- Monte Carlo error is on the order \(1/\sqrt{n}\), so not great if more direct approaches are available and tractable.

Upcoming Schedule

Next Classes

Friday: Simple Climate Models and Uncertainty

Next Week: Prescriptive Models and Intro to Optimization